Terry Smith is a man who uses words like a sniper uses bullets and, if you want to read something worthwhile, then his latest report is worth investigating. Of course, nothing beats the original and so any (fortunate) Fundsmith investors (or prospective investors) should obviously go straight here and look for the “Short Form Report For Period Ended 31st December 2014”. However, for anyone still here, I want to pick out an exceptionally useful table from this report; one which highlights what Fundsmith (i.e. The Big Man) considers as important criteria to use when evaluating a business:

- Return on Capital Employed

- Gross Margin

- Operating Profit Margin

- Cash Conversion

- Leverage

- Interest Cover

Return on Capital Employed

Smith highlights Buffett’s focus on this particular metric, which he (Buffett) considers the ‘primary test of managerial economic performance.’ Here is what the Sage said about this ratio in his 1979 missive:

The primary test of managerial economic performance is the achievement of a high earnings rate on equity capital employed (without undue leverage, accounting gimmickry, etc.) and not the achievement of consistent gains in earnings per share. In our view, many businesses would be better understood by their shareholder owners, as well as the general public, if managements and financial analysts modified the primary emphasis they place upon earnings per share, and upon yearly changes in that figure.

Ok, to avoid confusion it is worth mentioning that Return on Capital Employed is not the same as Return on Equity. The difference between these two calculations is simply debt–namely, ROCE takes account of debt but ROE doesn’t. ROCE, to me, seems better; you certainly want to know about it if a company is using heavy gearing to juice its numbers.

Smith explains ROCE as, for every pound of capital you own, the percentage of that pound which is turned into profit. Investopedia, tells us that this is calculated as follows: ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed Morningstar informs us tha, for PZ Cussons (a company I am currently investing in) the ROCE is 30%. Fundsmith puts the figure at 18% for the FTSE 100 and reveals that for his investee companies the average is 29%.

Gross Margin

According to Investopedia this is a company’s total sales revenue minus its cost of goods sold, divided by the total sales revenue, expressed as a percentage.

According to the FT, PZ Cussons’ Gross Margin is 39%, virtually identical to the wider market which has a gross margin of 40%. Smith explains this as a company making something for £6 and selling it for £10. His companies earn fat gross margins of about 60%.

Operating Profit Margin

Calculated by dividing Net Sales into Operating Income, this is defined by Investopedia as is a measurement of what proportion of a company’s revenue is left over after paying for variable costs of production such as wages, raw materials, etc. It is calculated before interest and taxes, and is best evaluated relative to a company’s competitors and to itself, over time.

For PZ Cussons, the current operating margin is 14.76%, whereas it is about 16% for the market as a whole. Smith’s investee companies clearly take this round, chalking up an average margin of 25%.

Cash Conversion

How much out of every £1 of profit is converted into cash? The market as a whole manages 80p, with the missing 20p going to working capital and capital expenditure.

Smith’s companies again outperform, by converting more than £1 into cash. There is no description of how this is calculated and, having looked at various sources online there seem to be a number of options available. One method is to divide Operating Profit into Operating Cash Flow.

For PZC this is 96.9/128.6, which at .75 appears to be slightly worse than the general market and worse also (needless to say than the redoubtable Mr. Smith’s companies).

Leverage

The original double-edged sword this one, defined by Smith as net debt (net of cash) of Shareholders’ funds.

For PZ Cussons, gearing is a very conservative 10.02%, whereas for the market it is around 40%. Family companies are usually reliable in that way–they have a next generation to worry about and it shows in debt aversion, where as bonus-focused managers have anything to bequeath. Smith’s companies have leverage of about 25%, and so PZ Cussons takes this round.

Interest Cover

Leverage becomes more of an issue if interest–how many times a company covers its interest charges with its profits–cover is thin.

PZ Cussons’ interest charges are covered more than 32 times, which means that the debt is presently nothing whatsoever to worry about. This financial strength should give the company the freedom to borrow to invest, should it come across an opportunity. Smith says that, for the market as a whole, interest cover is less than 10 times but that his companies’ interest payments are covered 15 times.

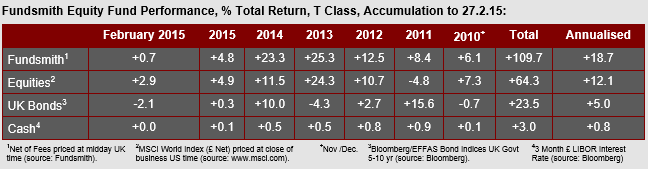

Terry Smith, armed with a simple sword for waffle-busting and trusty shield of common sense, has in a few short years made the supposedly complex business of fund management look rather straightforward:

- Identify the highest quality companies (see criteria above) in the most investor-friendly industries

- Buy them

- Hold them

- Reinvest the dividends as they trickle in

That’s it, and heaven help anyone who tries to make the whole business too complicated! Results update:

And as for PZ Cussons? I bought a few more. Excellent returns on capital and a very safe, conservatively run family business.

Disclosure: Long PZC.

Disclaimer: This post is not a recommendation to either buy or sell. Please consult your investment advisor.