Fundsmith, the fund manager run by Terry Smith, has launched a new investment trust conveniently named (for cheap punsters) Fundsmith Emerging Equities Trust (FEET). Hope springs eternal in the fund management industry and, despite the lack of any emerging markets track record, the trust is currently selling at a premium of 8%.

Until this point Fundsmith has kept things simple by running a single fund that invests in global equities. The fund has avoided many of the classic fund management mistakes by:

- Limiting the number of its investments to between 20 and 30 companies to avoid becoming just another expensive index tracker.

- Buying only high quality businesses that earn a high return on capital (think Imperial Tobacco rather than National Grid).

- Holding its investments for a long time, rather than trading in and out.

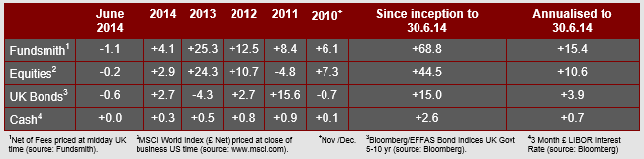

The results have been good and, after fees, the fund has comfortably beaten the MSCI World Index over the last 3 1/2 years:

I can’t think of a reason why this approach shouldn’t also work in emerging market shares, but it will be interesting to see whether the number of holdings increases. Most emerging market funds seem to hold many more shares than developed market funds; whether that is due to corporate governance fears, volatility or less certainty by the manager I do not know, but any of these three reasons by itself would be enough for me not to invest in the company at all. It will be interesting to see how Terry Smith approaches emerging markets, what he buys and how much he buys.

But, with the trust selling at a premium of 8%, that is beside the point. Buying an investment trust with a premium of 8% is like going into business competing against a shop next door, but then paying substantially more than them for all of your start-up stock. You can’t win like this so why would you even try? If the average return of an emerging market investment trust is, say, 8% and you buy it at a premium of 8% then, having paid your money, you should expect to wait for a full year before you can even contemplate starting to make a real return. If the trust does badly, and its net asset value falls, then widespread disillusionment and disgust is likely to sweep the shareholder base and the premium will very quickly become a discount. That fall, when added to a NAV fall, could easily see a third of your starting capital wiped out. You will probably be utterly repelled and sell at the low point to rid yourself of the embarrassing mistake staring out at you when you log onto your brokerage account.

A similar problem occurred with Anthony Bolton’s recent offering–the Fidelity China Special Situations trust. Bolton was a genuine star in fund management and, allied with some fine marketing of the China story by Fidelity, this proved to be a great selling point and the trust shot to a 10% premium on launch. Unfortunately, the Chinese market refused to fall into line with Fidelity’s marketeers and Bolton turned out to be human, making some mistakes along the way. With Bolton recently re-retired, the fund is now selling for about 4% more than its start date over four years ago and the 10% premium has slithered to an 11% discount. The China Special Situations trust no longer seems to feature in as many of the Sunday newspaper money section articles as it used to.

Of course it isn’t Terry Smith’s fault that his trust is selling at a premium–if people want to pay more for something than its market value, in their impatience not to miss out, then it is their choice. But, just as a health warning is stamped on the side of a cigarette packet, perhaps an even stronger financial warning should be stamped on an investment trust selling at substantial premium:

You are paying 10% more for this investment than it is worth. This is likely to be injurious to your financial health.

Terry Smith has established a good fund management track record, but if you pay an 8% premium for his efforts then nothing short of Buffett levels of perspicacity and business acumen will suffice. Surely it would be better to sit back and wait for the premium to disappear before investing? All good things come to he who waits.