The latest career move of Bill Gross (the Bond King) has caused tremendous excitement in the financial media over the last few days. Just in case you have been on holiday, Mr. Gross has departed PIMCO (the company he founded) for Janus Capital. Reading between the lines, some of his colleagues at PIMCO are not too disappointed by his departure.

While British investors might know BG as the man who said–at a time of considerable national angst–that gilts were resting ‘on a bed of nitro-glycerine’, American investors of a certain vintage will remember him as the man who milked a thirty year bull market in treasuries for all it was worth. The nitro-glycerine remark came at the beginning of 2010 when Gross singled out the UK gilt as a ‘must avoid’. He continued on, in a somewhat poetic vein, as follows:

…the highest debt levels and a finance-oriented economy– (is) exposed like London to the cold dark winter nights of deleveraging.

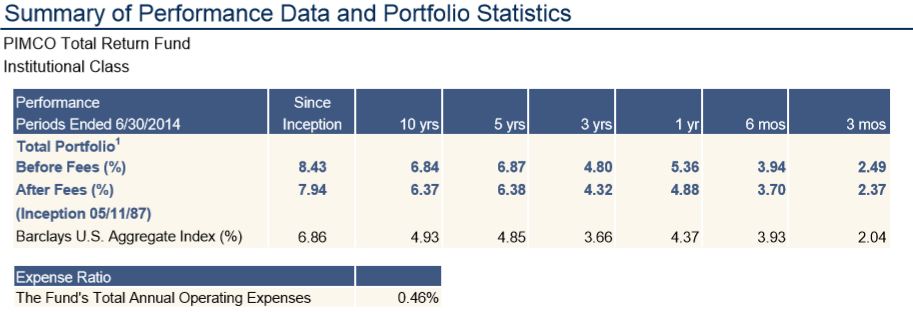

Well, yes, no doubt some day but it didn’t happen in 2010, 2011, 2012, or 2014. But on the Treasury market, despite a few hit and miss calls in recent years, his record is excellent. 23 positive years out of the last 26 went into the following:

But that is history and these returns cannot be purchased today, which begs the question: why are so many bond investors readying to follow their King to Janus? At least, that is the implication behind a surge of an amazing 43% in the Janus Capital share price on the day that Gross’ move was announced. That looks overdone if you consider the expected effect on earnings; Credit Suisse analyst Craig Siegenthaler raised Janus’ earnings forecast to $1.02 per share for full-year 2015 earnings (up from 96 cents) and to $1.23 for 2016 (from $1.03, see Forbes for details), increases of only 6% and 19% respectively. While Siegenthaler expects Janus’ fixed income segment to grow by $30-40 billion over the next few years (from about $30 billion), Kenneth Worthington is even less optimistic and predicts that Janus will raise only $3 and $6 billion of fixed-income assets in the coming year. Either prediction would appear to leave Janus Capital shares precariously placed following their huge Gross-inspired price surge.

For the bond market, meanwhile, things do not look good. When a bright and bushy-tailed young Bill first skipped into the fray in the 80s, the 10-year yielded a chunky 8.67%, whereas today it is a measly 2.52%. Surely, there is now much more downside than upside for bond investors*? Can a seventy-year old Bill Gross really be expected to swim successfully against the coming tide for long enough to make buying into his fund worthwhile?

It is difficult to see who is being more optimistic here: Janus Capital investors or Bill’s legion of devotees. I will neither be buying Janus shares nor investing in the fund.

* Yes, I know, Japanese Government Bonds currently yield a remarkable 0.52%. But, surely not even Bill in his wildest dreams expects that?